Get Help Now

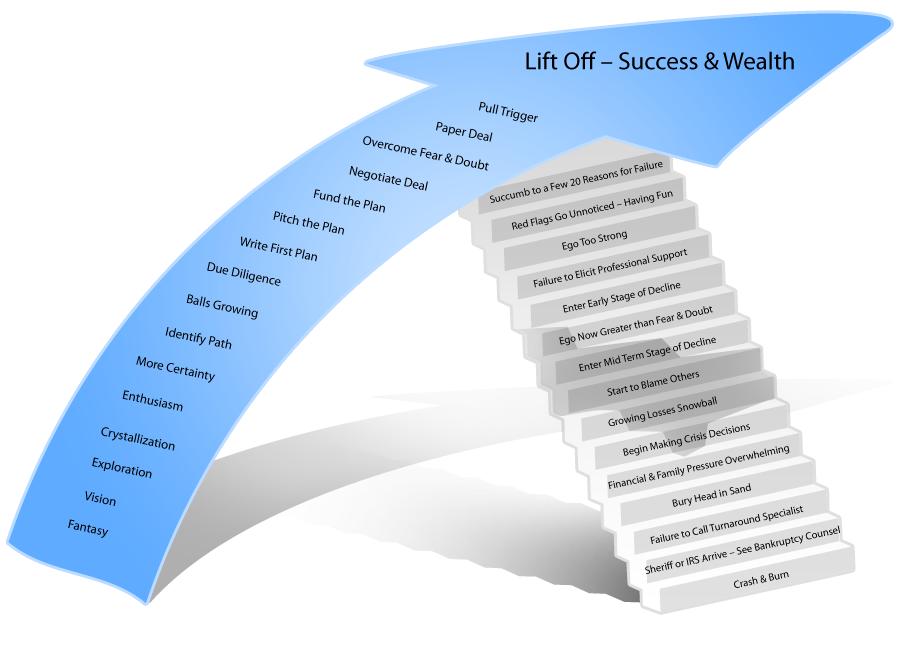

How Deep Are You?

What To Do?

-

1.Don’t be Embarrassed.Whether from internal or external forces, you’re not alone. From doctors to bricklayers it can happen to anyone. 30,000 companies file bankruptcy each year.

-

2.Face the Predicament.Problems normally worsen. The “light at the end of the tunnel” could be an oncoming train.

-

3.Don’t Borrow.Avoid more debt; the process consumes valuable time that should be spent solving the root of the problem. Borrowing is the easy way out. If you need capital, consider investors.

-

4.Don’t Use Credit Cards.While there are few limited times and extraneous reasons to favor, credit card borrowing, high interest rates only compound the problem.

-

5.Slash Costs.Most businesses have 5% fat. Axe non-essential expenses.

-

6.Meet with Your Banker.Banks behave differently now. They may not want to foreclose. Nowadays the bank may be in more trouble than you!

-

7.Get Accurate Numbers.Financial statements and budgets are tools you need to make repairs.

-

8.Determine Seriousness.Based on the stage of decline, come to grips with how far your business regressed.

-

9.Get Help.The sooner you get help, the better chance of recovery. If in a “crises mode,” develop an aggressive strategy with your lawyer, accountant and business advisor. You must take this step to gain expertise and because you were unable to initially define or correct the problems.

-

10.Formalize Your “Turnaround Plan.”Reduce your recovery plan to writing. Then, systematically implement change and monitor progress. Your Plan may include demanding deeper discounts, payable discounting, factoring receivables, selling-off underutilized assets, stretching out loans, downsizing and a host of other actions.

CALL US NOW

We Can Help!

800-532-1900

Initial Consultation!

No Fee

No Fee